The Theory of Startup Funnels

Want to own the shoes Michael Jordan wore in the 1988 dunk contest?

I sure do. And I can… sort of. Rally, a company that makes “the investments of the rich available to all,” lets you a buy “share” of expensive, rare things as if they were a stock. Things like 1968 Ferraris, one-of-a-kind Rolexes, and Birkin bags. If the value goes up, you, as the “investor,” make a profit.

Rob — one of the founders — came on the podcast. He’s great. It’s worth a listen.

But…

After the conversation, there was something about Rally I couldn’t shake. The founders are smart and capable, the product is great, the market is huge. Accordingly, they’re growing fast. Their last round was led by Upfront, one of the best investors on planet earth.

So what was bothering me?

It all seemed too… normal. Predictable, even. Idea → product → growth → funding → growth. Linear. Repeatable. I’ve picked up a few nuggets working in and around early startups the past 13 years and one of them is that words like “predictable” and “repeatable” are theory not practice. They don’t ever actually happen. Unless, apparently, you’re Rally.

So I dug in.

I needed to find what they were doing that others weren’t. I’ve admittedly thought way too much about Rally over the past month.

But I’ve got a theory.

It’s changed a lot about how I think through early stage opportunities, and I think it’ll be supremely helpful if you’re figuring out how to grow your startup, or picking a startup idea to pursue.

From a high level — we think about customer acquisition completely wrong for early-stage startups, and if you think about it right you can grow like crazy.

And Rally has, without a doubt, the greatest early-stage customer acquisition funnel I’ve ever seen.

We’re talking about funnels?

Startup founders in 2020 pride themselves on being data driven.

But more accurately, startup founders in 2020 pride themselves on saying they’re data driven. The big problem with being data driven as an early-stage founder is it’s easy to say and nearly impossible to do. You never have enough data to drive anything.

So, it’s data driven is now ambiguous — something we all nod and say and don’t question like when a founder says they’re building with “lean methodology.”

Sure?

One of the things founders know they’re supposed to be data driven around is their customer acquisition funnel.

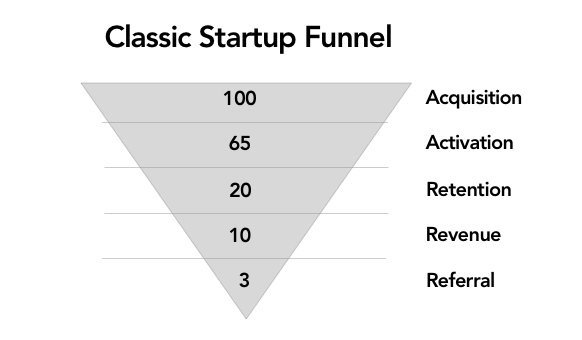

Most founder’s funnel journey starts and ends with the famous (and well-titled) Pirate Metrics post by Dave McClure — AARRR. Founders read that post, build out a sheets doc, then proceed to never look at it again. Because as an actual measurement tool for early-stage folks, the classic startup funnel stinks.

The ubiquitous, useless, funnel

The theory is this funnel will show how many customers slip through the cracks. Then, you can a/b test tactics to fix activation or retention or whatever. The reality is, it won’t. You won’t have enough customers coming in the top of the funnel to have any clarity into where they drop out. You won’t have enough traffic for real A/B tests, either. They’ll always result in things like “8 customers converted through path A, 5 through path B.” The result of the majority of these sorts of efforts early on to be data driven will be the shrug emoji.

The AARRR funnel is great if you’ve raised a series A and have a marketing budget and consistent top of funnel traffic. But you haven’t and you don’t.

So who cares? Why not ignore funnels altogether until you have enough traction that it’s helpful?

Because what is measured is managed, and since you can’t really measure, you won’t really manage your funnel. And that’s bad.

Because Rally’s funnel took them from a guy I met at a coffee shop in 2015 who had a vague idea on a napkin into one of the hottest startups in NYC in 2020. And it had nothing to do with split testing or the AARRR framework.

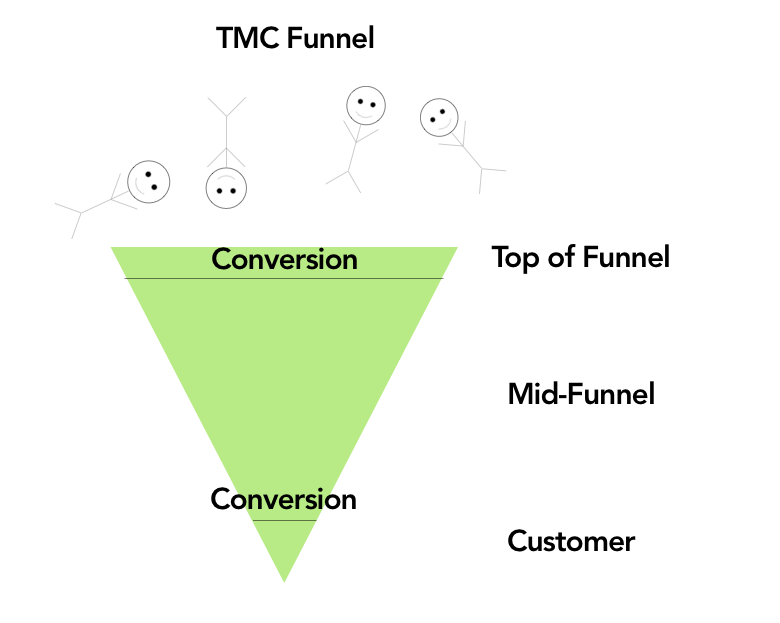

The TMC Funnel: An Early-Stage Startup Funnel in 2020

The dirty little secret of early stage startups is that the internal product you build is way more important than the external product. The great thing about the internal product early on is that you can measure it. You can own it. You can improve it. And it matters.

Rally’s “external product” is their app. It’s got a nice design and features. But it’s a commodity. In 2020, nearly every product is a commodity. Maybe you need nice branding or XYZ features, but you can throw a reasonably small amount of cash at all of that.

Something you can throw a reasonably small amount of cash at will never be a differentiator. Which means, it doesn’t actually matter.

What will be a differentiator is your internal product. It’s not something everyone can outsource.

I call it the TMC Funnel because I spent all my time making the imagery below and didn’t spend any time thinking of a name. I’m open to suggestions.

The funnel has three sections. Top, mid, and customer. Each section should be treated as it’s own mini product, though they’ll play nicely together.

The funnel isn’t an excel sheet. It’s a living, churning, tool that when humming properly will drive the entire company.

Here’s how you can implement it.

Top of Funnel

I visualize the top of funnel machine as a bunch of those sticky hands toys from back in the day. The goal is to find your customers and yank them into your orbit. They’re going about their daily lives, and you snap them up. You need to take them. Their time and attention is zero sum, and you snatch it. Customer acquisition is active.

These hands each represent a channel. It’s a channel your customers are already in, and you’re getting them by presenting something overwhelmingly compelling. Something so different and interesting people give you permission to tell them more. This almost always means something hyper-specific — more specific than anything else in the channel to them.

If you’re a new DTC brand, the lazy approach is a 25% off coupon through a well-branded Instagram ad. That doesn’t work anymore.

Top of funnel is where you need to leverage essentialism (read it). You’ll test out 10x as many paths as other companies and go deep on 1/10th as many. This strategy takes time **and effort. You’re like Andy Dufrense chipping away at the wall. You’ll need to test lots of approaches, channels, calls to action, and outcome messaging. Don’t sweat it.

I suggest 2-week sprints with 2–3 channels / messages being tested. Invest some moderate cash into this. A budget of $75 — $125 per sprint should be plenty, and hopefully you can find free channels and won’t need it. Be creative. Top of funnel is where you flex your persona muscle — where are your customers on a Tuesday night? How can you be there, too? How can you create an event they come to? Prove you know your customer better than any competitor.

A recent Tacklebox company is selling art supplies for grown ups and they’ve been partnering and hosting figure drawing nights. This is an incredible way to get people into the funnel, engaged, and aware of the type of brand you are.

People will only convert when they feel something. When they learn something. When there’s nostalgia involved. When they can teach someone something. All the shareable things from Contagious.

Rally has top of funnel perfection. Shareable, interesting, nostalgic stories around the things they sell. Brilliant, repeatable, amplified by customers (retweeting, re-sharing, screen-shotting and popping in a group text).

Mid-Funnel

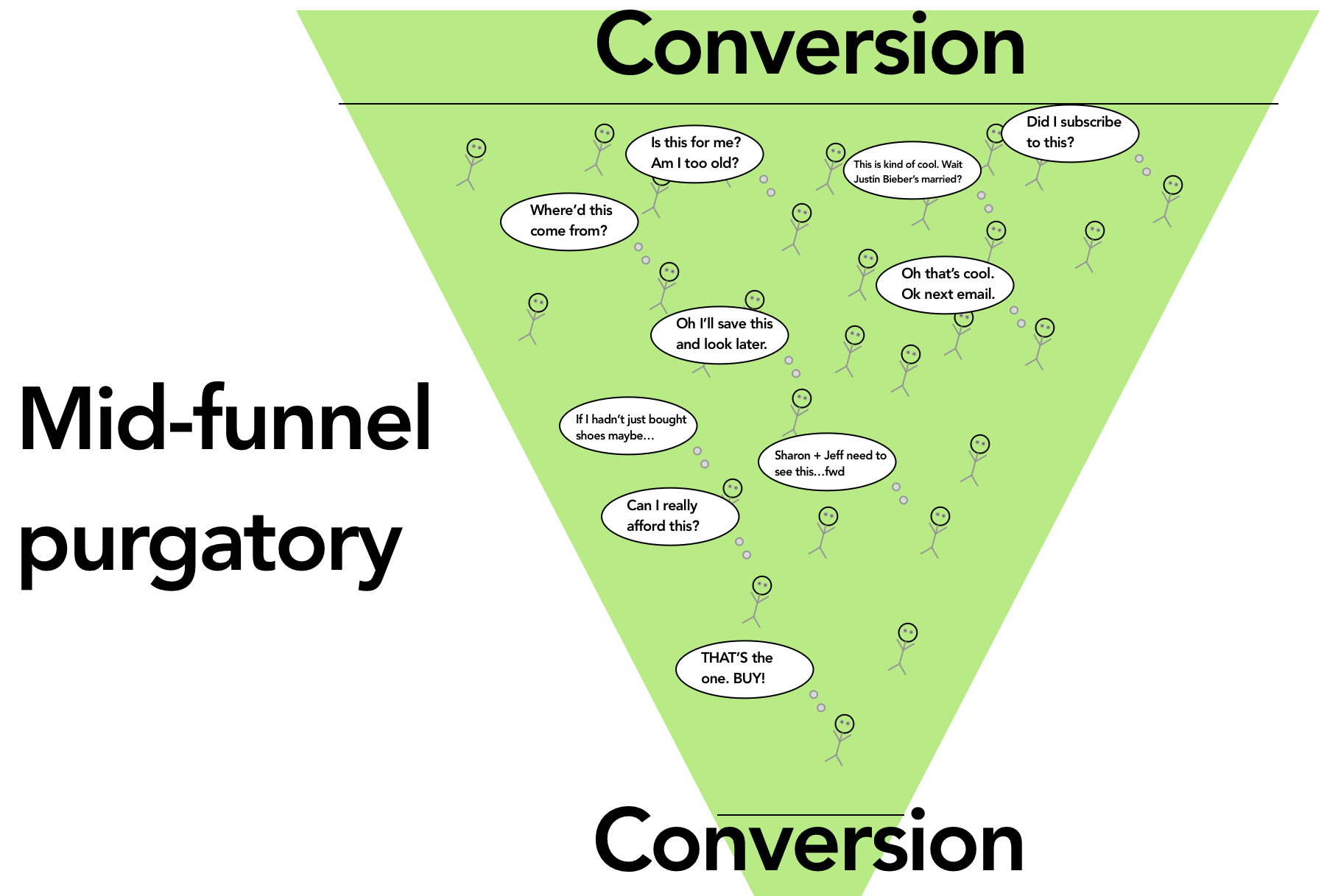

Mid-funnel has been eye-opening.

Everyone thinks about top-of-funnel. But top-of-funnel shouldn’t be hard. If you can’t get people excited enough to do one thing, you were screwed anyway. Mid-funnel is what your company depends on. Mid-funnel is the guts of your funnel “product.”

Why?

Because your customer is going to need 6+ compelling touch-points with your company before they buy. When you’re mature, those touch-points will come from all over — earned media, referrals, etc. Early on, they’re all created by you.

That means you’ll need to be able to reach out and poke your customers 6, 8, 15 times before they buy. You need an interesting, compelling mid-funnel strategy. This is… hard as shit.

A good way to visualize your mid-funnel is through unit-economics. Zoom in on each customer’s journey through the funnel, thinking about how they feel at each touch-point.

Your “mid-funnel” will have folks at all stages. I think of it, weirdly, like a kind of product purgatory. They’re waiting for something to convert them, one way or the other. They’ll buy, or they’ll unsubscribe.

Think of customers individually through the journey,

Each touch-point will be building trust — I think of it, again, very visually.

There are three questions you need to think about for mid-funnel:

What is your mid-funnel strategy? What are you pinging customers with that’ll be interesting, compelling, potentially shareable, and will eventually build enough trust to convert?

How easily can you create those touch-points?

How compelling is the call-to-action to convert them once they’re ready?

DTC mid-funnel strategies tend to be sale-based… disaster.

What’s a good touch-point look like?

The best touch-points are evergreen — they don’t have an expiration date. The worst are one-off, like a 15-min introductory call. Maybe that’s your final “close” touch-point, but it shouldn’t be top of funnel.

I just finished this video — it was expensive and took a while, but hopefully it’s evergreen and will be a consistent touch-point that pushes customers down the funnel.

Rally’s mid-funnel is, again, brilliant.

They send emails and tweets with stories about the products they sell. The interesting content (expensive, flashy things with cultural significance) let me dip my toe in the water. For products that have a new theory — like investing in physical goods like a stock — the funnel will be longer. You’ll need to educate your customers for a bit.

For startups that need to educate customers, mid-funnel strategy is your lifeblood.

Here’s how the Rally funnel looks from a unit economics standpoint. I sign up for the email list after a friend texts me a 1968 Ferrari auction. I get weekly emails for 3 months. I see cool stories about cars, watches, bags. I see each sells out, so people like me must be investing. The boundaries become clear.

Then, Michael Jordan’s shoes come up. I’m a basketball fan. I’m a Jordan fan. I’m a Nike fan. It’s my time — I buy.

All of that content from Rally is evergreen. It’s easy to create, because it’s an offshoot of their core product. Their flywheel is incredible — get an item, sell it, leverage the collateral to push people slowly through the funnel.

Grow like a Glacier

This isn’t an actual glacier, when I did image searches for those I went down a severely depressing climate change rabbit hole. So, here’s the wall from Game of Thrones. Pretend it’s a glacier.

This funnel, particularly the mid-funnel, is now a big part of how I evaluate companies.

So… how compelling is your mid-funnel?

Maybe more importantly… how compelling CAN it be?

I don’t care if conversion takes a year — can you keep people warm, fat and happy through a long mid-funnel stay? Can you give them something that’s compelling and shareable and builds that trust?

If you’re selling jackets for dogs… can you really create 10 touch-points? How?

If so, you’ll have what I now think of as Glacier Growth. You’ll grow slow — it might take someone a year in the funnel before they convert — but you’ll be building up a massive queue. They’ll all convert at sometime, so while your growth might look slow the first year, it’ll compound. It’ll be powerful and lasting and will sneak up on you.

So five years after Rob showed me that sketch, Rally is finally hitting their stride. And they’ll have a massive group of customers in the mid-funnel, waiting to convert. The long-term strategy paid off.

So, what is it about Rally?

The mid-funnel, man. The mid-funnel.